HELOC Payment Calculator

This calculator will help you determine whether you're eligible for a home equity loan or a home equity line of credit

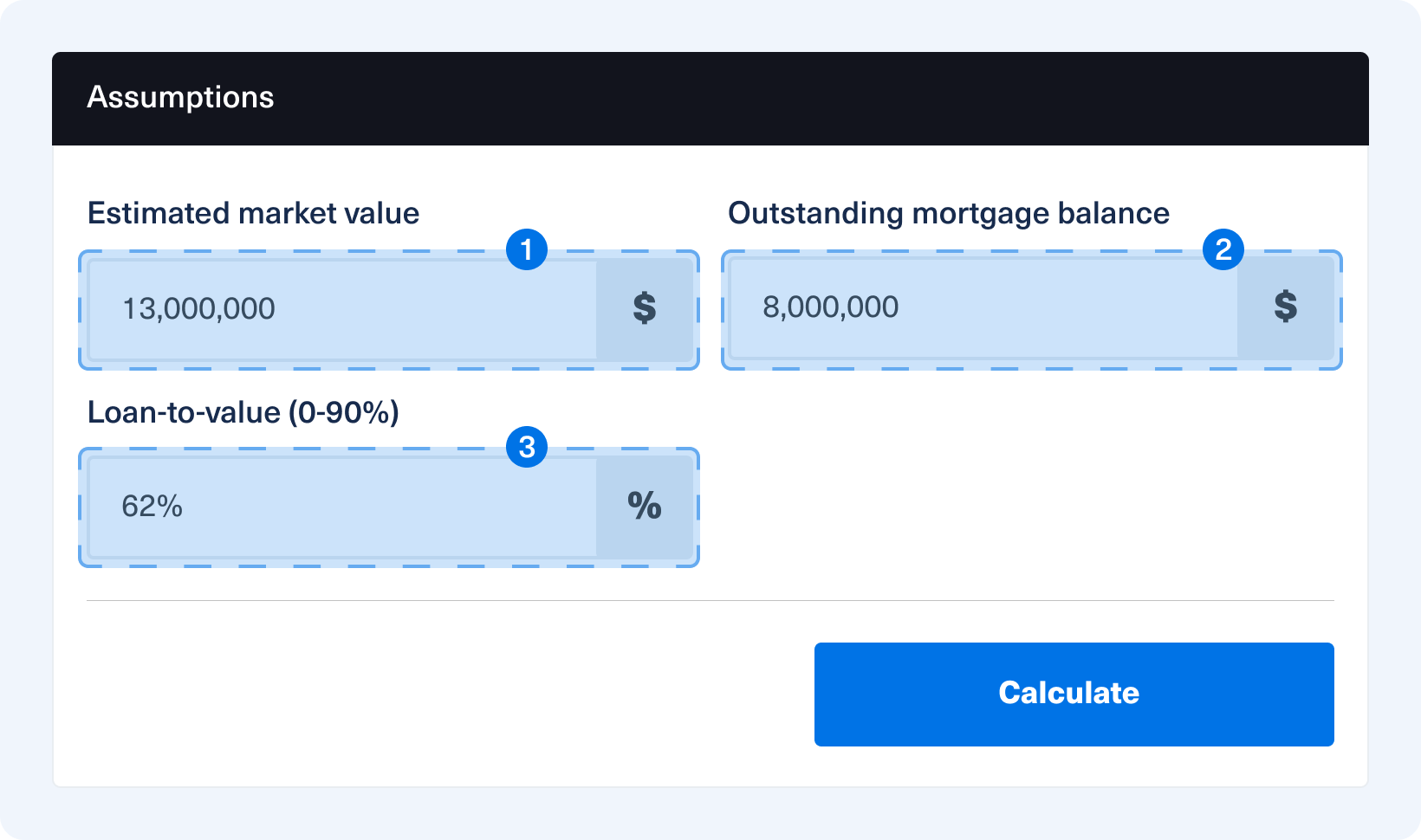

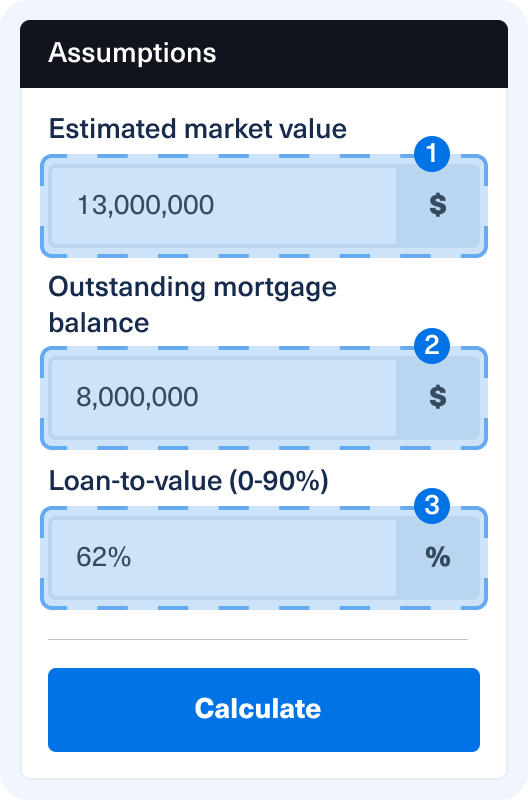

Assumptions

Results

This calculator will help you determine whether you're eligible for a home equity loan or a home equity line of credit

HELOC stands for “home equity line of credit.” It is a type of revolving credit that is secured by the equity in a borrower's home. A HELOC allows homeowners to borrow money against the value of their home, up to a certain limit set by the lender. NeighborWho’s HELOC calculator could help you figure out whether a HELOC is worth it for you.

Unlike a traditional loan, which provides a lump sum of money that must be repaid over a fixed period of time, a HELOC loan works more like a credit card. The borrower can draw on the line of credit as needed, up to the maximum amount allowed by the lender. The borrower only pays interest on the amount borrowed and can repay the balance and draw on the line of credit again as needed.

HELOCs can be a useful source of funds for homeowners who need to make home improvements, pay for college tuition or cover other major expenses. However, they also carry risks: failing to repay the loan could result in foreclosure on the home. It's important for borrowers to calculate their HELOC payment and carefully consider their financial situation and ability to repay the loan before taking out a HELOC.

When you apply for a HELOC, the lender will typically review your credit score, income and other financial information to determine your creditworthiness. If you are approved for a HELOC, the lender will set a credit limit, which is the maximum amount you can borrow against your home's equity.

Once the HELOC is established, you can use the funds as needed by writing a check, using a debit card or accessing the funds online. You only pay interest on the amount you borrow, not on the full credit limit.

Here's how the HELOC process works:

To get a HELOC, you'll need to apply with a lender and go through the approval process. Lenders will consider factors such as your credit score, income and the amount of equity you have in your home when deciding whether to approve your application.

Once approved, you'll be given a credit limit, which is the maximum amount you can borrow. This credit limit is based on the value of your home, your creditworthiness and other factors.

The draw period is the time during which you can borrow against the credit limit. This period is typically 5 to 10 years, depending on the lender. During this time, you can borrow as much or as little as you need, up to the credit limit.

After the draw period ends, you'll enter the repayment period, which is the time during which you'll need to repay the balance of your HELOC. This period is typically 10 to 20 years, depending on the lender.

You'll only be charged interest on the amount you borrow, not on the full credit limit. The interest rate on a HELOC is typically variable, meaning it can go up or down based on changes in the market. During the draw period, you'll usually only be required to make interest-only payments. Once the repayment period begins, you'll need to make payments that include both principal and interest.

Your home is the collateral for the HELOC, which means that if you don't make your payments, the lender can foreclose on your home. It's important to make your payments on time and in full to avoid this.

While a HELOC is a revolving line of credit, a home equity loan is a lump sum loan. With a home equity loan, you receive the full amount of the loan up front and then pay it back with a fixed payment amount over a set period of time, typically 5 to 15 years. A HELOC, on the other hand, is a revolving line of credit, much like a credit card, which allows you to draw from the available credit over time and make payments as you go.

The benefit of a home equity loan is that you receive the full amount of the loan up front and can budget accordingly for the monthly payments. A HELOC, on the other hand, can be more flexible since you only borrow what you need, but it can also be more challenging to budget since the repayment amount can vary from month to month.

Both HELOCs and home equity loans allow homeowners to borrow against home equity, but there are some important differences between these two types of loans.

Here's a breakdown of the similarities and differences between a HELOC and a home equity loan:

Both HELOCs and home equity loans use the borrower's home equity as collateral.

Both types of loans typically have lower interest rates than other forms of credit, such as credit cards or personal loans.

The interest paid on both types of loans may be tax deductible, depending on the borrower's individual circumstances.

HELOCs are a type of revolving credit, similar to a credit card, while home equity loans are installment loans with a fixed term and fixed payments.

With a HELOC, borrowers can draw funds as needed up to their credit limit during the draw period, while with a home equity loan, borrowers receive a lump sum of cash up front and make regular payments to repay the loan over time.

HELOCs usually have variable interest rates, while home equity loans typically have fixed interest rates.

During the draw period of a HELOC, borrowers may only be required to make interest-only payments, while home equity loans require payments of both principal and interest from the outset.

HELOCs typically have higher up-front fees and closing costs than home equity loans.

Which one is better for you will depend on your individual financial situation and borrowing needs. HELOCs may be a good option if you need flexible access to funds over an extended period of time, while home equity loans may be a better choice if you need a lump sum of cash up front and want the security of fixed payments over a fixed term. It's important to shop around and compare offers from different lenders to find the loan that best meets your needs.

One of the advantages of a HELOC is its flexibility in how it can be used. Homeowners can use a HELOC to pay for a variety of expenses such as home renovations, college tuition, medical bills or even to consolidate an existing debt with a higher interest rate.

Another common use of a HELOC is to access funds for a down payment on a second home or investment property. By using the equity in your primary residence, homeowners can secure a lower interest rate and better terms than they would with an unsecured loan.

Here are some common uses for a HELOC:

Many homeowners use HELOC funds to make improvements to their homes, such as remodeling a kitchen or bathroom, adding a room or installing a new roof.

HELOC funds can be used to pay off high-interest debts, such as credit card balances or personal loans, which can help consolidate debt into a single, lower-interest payment.

HELOC funds can be used to pay for education expenses, such as tuition, textbooks and housing.

HELOC funds can be used to cover unexpected expenses, such as medical bills, car repairs or home repairs.

Some homeowners use HELOC funds to make investments, such as purchasing stocks, starting a business or investing in real estate.

HELOC funds can be used to fund travel expenses, such as vacations, cruises or travel for work.

It's important to note that while a HELOC can provide access to funds for a variety of purposes, it's essential to borrow responsibly and only use the funds for necessary expenses.

Borrowing against your home equity means you're taking on additional debt and will be required to make monthly payments until the loan is fully repaid. You can use NeighborWho’s HELOC repayment calculator to see the long-term financial implications of taking on a HELOC before making a decision.

To calculate the maximum amount you can borrow with a HELOC, you first need to determine your home's current market value and the amount of any outstanding mortgage debt. Subtract the outstanding mortgage debt from the current market value to get your home's equity.

Here's how to calculate the potential HELOC loan amount:

To calculate your home's equity, subtract your outstanding mortgage balance from your home's current market value. For example, if your home is worth $400,000 and you owe $250,000 on your mortgage, your home equity is $150,000.

To calculate your loan-to-value (LTV) ratio, divide the amount you owe on your mortgage by your home's current market value. In the example above, the LTV ratio would be 62.5% ($250,000/$400,000).

Each lender may have different criteria, but most will require an LTV ratio of 80% or less. For example, if your home is valued at $500,000 and the maximum LTV ratio is 80%, the maximum amount you can borrow with a HELOC would be $400,000 (80% of $500,000).

Your credit score will also play a role in how much you can borrow with a HELOC. The higher your credit score, the more likely you are to qualify for a larger loan amount.

It's important to note that the amount you qualify for may vary depending on the lender's criteria and your individual financial situation. Borrowing against your home equity means taking on additional debt and increasing your monthly payments, so it's important to borrow responsibly and only take out what you need.

Here’s how to use NeighborWho’s HELOC calculator to figure out how much you can borrow.

Enter your home's current market value in the calculator. If you're unsure of your home's value, you can check recent home sales in your area or consult with a real estate agent.

Input the amount you still owe on your mortgage.

Your LTV ratio is calculated automatically based on the entered values above. Typically, most lenders will require an LTV ratio of 80% or less.

Once you've entered all the required information, tap Calculate. The calculator will display the estimated maximum amount you may be able to borrow with a HELOC.

HELOC payments are calculated based on the amount borrowed and the interest rate. With a HELOC, you only pay interest on the amount you borrow, not on the full credit limit. This means that your payment amount will vary depending on how much you borrow.

The interest rate on a HELOC is typically variable and tied to the prime rate or another benchmark rate. This means that your interest rate may fluctuate over time, causing your payment amount to change as well. Most HELOCs have a draw period, which is the time during which you can borrow against the line of credit, and a repayment period, which is the time during which you must repay the balance.

During the draw period, your payments will typically be interest-only. This means that you are only required to make payments on the interest that has accrued on the amount you have borrowed. Once the draw period ends, you will enter the repayment period, and your payments will include both principal and interest.

It's important to understand that if you make only the minimum payment during the draw period, you will not be paying down the principal balance and will end up owing the full amount at the end of the draw period. To avoid this, it's a good idea to make additional payments during the draw period or to start paying down the principal during the repayment period.

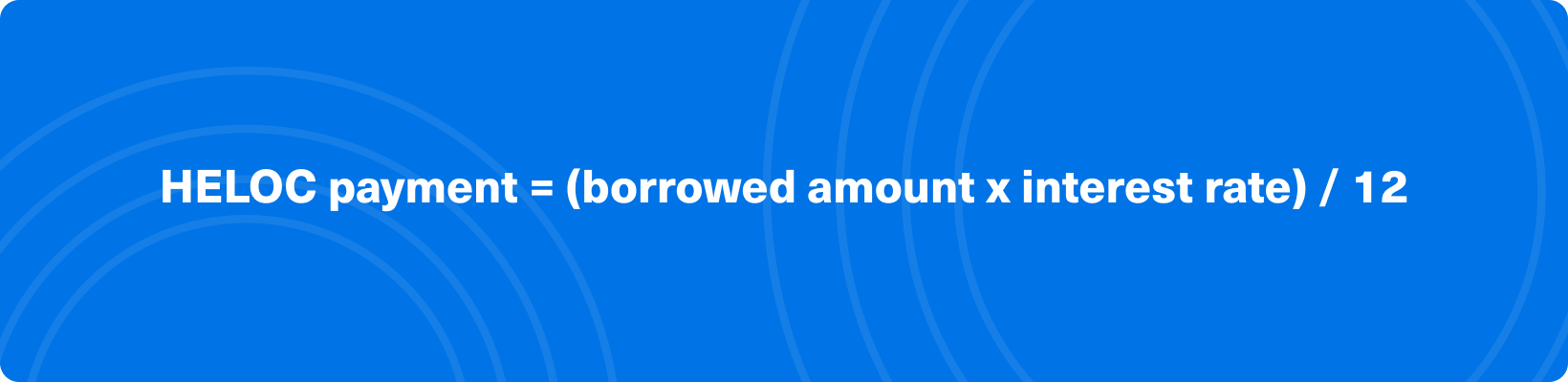

To calculate your HELOC payment, you can use NeighborWho’s HELOC loan payment calculator or the following formula:

For example, if you borrow $50,000 with a HELOC that has an interest rate of 5%, your monthly payment during the draw period would be $208.33 ($50,000 x 5% / 12). Once the repayment period begins, your payment would include both principal and interest, which would be calculated based on the remaining balance and the interest rate at that time.

NeighborWho’s HELOC calculator provides only an estimate of the maximum loan amount you may be able to borrow, and the final amount may vary depending on your lender's criteria and your individual financial situation. It's important to use the calculator as a tool to guide your decision-making process and to borrow responsibly, only taking out what you need and can afford to repay.